Once you register for GST Number, you must make quarterly returns of the tax you have charged to your customers. You will also be able to claim a refund or credit for any GST you have incurred on your business expenses. Similarly, there are separate returns for a taxpayer registered under the composition scheme, taxpayer registered as an Input Service, a person liable to deduct or collect the tax. A business in most cases will be required to furnish 3 returns monthly and 1 annual return. That means any business will require to file 37 returns in a financial year.

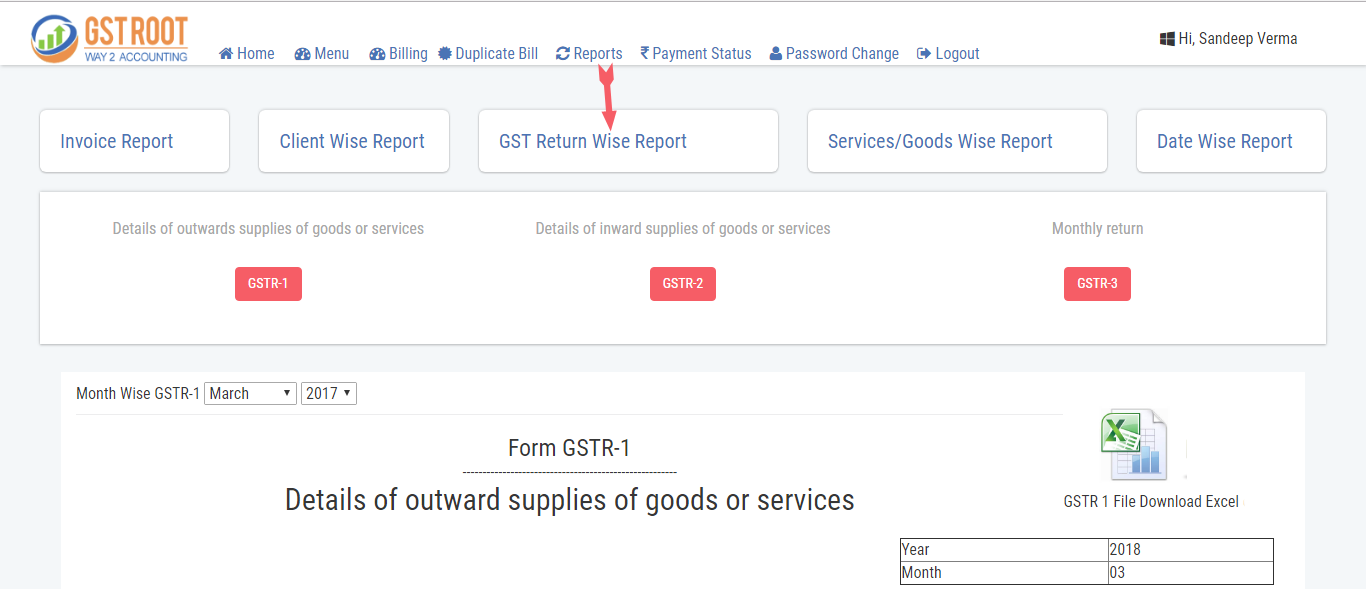

You can submit your GST Return from GSTROOT.COM, Here is the Process :

1. Online (www.gstroot.com)

2. Taxes Returns Submission System (TRSS)

3. Paper form (available from the Taxes Office)

Your return is due for submission no later than the last day of the month following the return period.

How to install GSTR-1 offline utility on windows computer?

First you need to download the offline utility from GST portal. Link to download the utility is

https://www.gst.gov.in/download/returns

After downloading the utility extract the files in a folder. The download will be in a ZIP file you first need to unzip it.

GSTR 1 Return